An In-Depth Analysis of MSCI: A Leader in Investment Decision Support Tools

I. Introduction

MSCI Inc. is a leading provider of investment decision support tools, including indexes, portfolio risk and performance analytics, and ESG research. In this article, we will delve into MSCI's history, its diverse range of products and services, financial performance, competitive landscape, and future growth prospects.

II. Brief History of MSCI

Founded in 1969, MSCI has grown to become a global leader in the financial services industry. Originally a subsidiary of Morgan Stanley, MSCI went public in 2007 and has since expanded its reach, with offices in over 20 countries and serving clients in more than 80 countries.

III. Overview of Products and Services

a. Indexes

MSCI is best known for its equity indexes, which serve as the basis for various investment products such as ETFs and mutual funds. MSCI's flagship product, the MSCI World Index, represents large- and mid-cap stocks across 23 developed markets.

b. Analytics

The company provides portfolio analytics tools that help investors assess and manage risk, optimize portfolios, and monitor performance. These tools cater to a wide range of clients, including asset managers, hedge funds, and pension funds.

c. ESG Solutions

MSCI's ESG solutions provide research and ratings on companies' environmental, social, and governance (ESG) performance. These insights help investors make informed decisions based on companies' ESG risks and opportunities.

d. Real Estate Solutions

The firm also offers real estate performance analytics and benchmarking solutions, providing investors with insights into global real estate markets and portfolio performance.

IV. Financial Performance Analysis

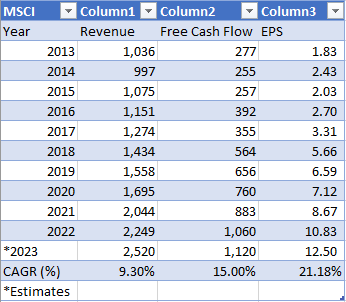

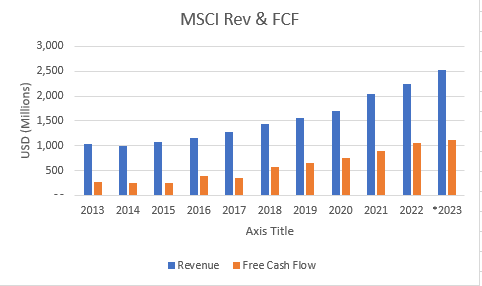

a. Revenue & Free Cash Flow Growth

MSCI has consistently reported strong growth over the past few years, driven by increased demand for its products and services. Through buybacks & prudent compensation, shareholder returns have outpaced the S&P 500 by a factor of almost 2 fold!

b. Profitability

The company's profitability has also improved over time, reflecting its ability to effectively manage costs and capitalize on growth opportunities. The operating margins have grown from close 36% to over 50% as of 2023, hence when revenue has grown by close to 9% annually, its FCF and net income have expanded much quicker.

c. Strong Returns on Invested Capital

MSCI's return on invested capital (ROIC) have expanded as well from 10% in 2023 to over 20% each year over the last 5 years. This demonstrates the company's solid financial performance and ability to generate value for shareholders.

V. Competitive Landscape

a. Competitors

MSCI faces competition from other financial data and analytics providers, such as S&P Global, FTSE Russell, and Bloomberg.

b. Market Share

Despite the competitive landscape, MSCI has maintained a strong market share in the index and analytics space, thanks to its extensive product offerings and global reach.

c. Competitive Advantages

MSCI's competitive advantages include its strong brand recognition, extensive product offerings, global presence, and focus on innovation and technological advancements.

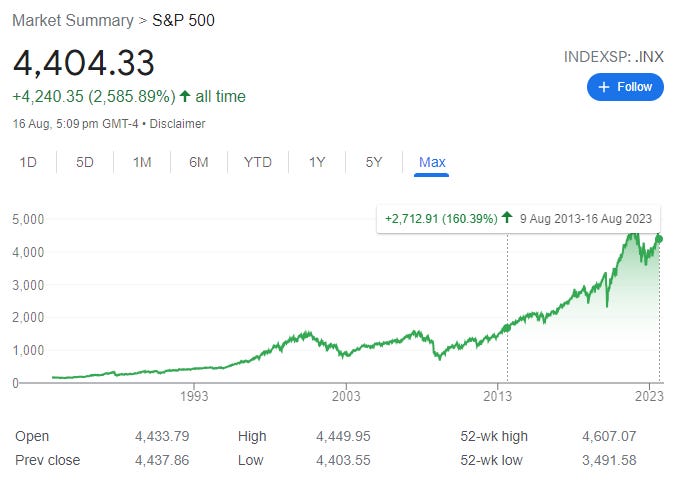

VI. Stock price returns

Despite the recent pullback, MSCI has still outperformed the index…

VII. Future Outlook and Growth Prospects

MSCI is well-positioned for future growth, as demand for investment decision support tools continues to rise. The company's focus on ESG solutions and analytics services, as well as its ongoing investments in technology and innovation, should drive long-term growth and value creation for shareholders.

VIII. Conclusion

MSCI has established itself as a leader in the investment decision support tools industry, offering a diverse range of products and services to meet the evolving needs of investors. With a strong financial performance, competitive advantages, and promising growth prospects, MSCI is well-equipped to navigate the challenges and opportunities that lie ahead.

Thanks for stopping by, if you enjoyed reading this, we suggest you read about BlackRock (BLK) and how it manages close to 10 trillion in assets.

We also have a YouTube channel, here’s one on some companies we looked at:

Disclosure: We do have a position in MSCI as of 17/08/2023, This is not a suggestion to buy or sell this security,

Past performance may not indicate future returns…