Quote of the day - "Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn't, pays it." - Albert Einstein

I. Introduction

Fair Isaac Corporation a.k.a FICO leads the charge in decision-making solutions. Its products and services help organisations make better decisions about lending, fraud prevention, and other critical areas.

This week’s newsletter will highlight how the company ticks, the financials and why it’s outperforming the S&P 500.

II. Brief History of FICO

FICO was founded in 1956 as Fair Isaac Corporation. The company was originally focused on developing credit scoring models, but it has since expanded its offerings to include a wide range of decision-making solutions.

III. Overview of Products and Services

The companies's credit scoring models are based on a variety of factors, including a borrower's payment history, debt-to-income ratio, and length of credit history. These models are used by lenders to assess the risk of lending money to borrowers.

Furthermore, it also offers a variety of other products and services, such as fraud prevention solutions, predictive analytics tools, and customer relationship management (CRM) software. These products and services are used by organizations in a variety of industries, including banking, insurance, healthcare, and retail.

Here are some specific examples of how FICO's products and services can be used for strategic decision-making:

A bank can use FICO's credit scoring models to determine which borrowers are more likely to default on their loans. This information can help the bank make better lending decisions and reduce its risk of losses.

A retailer can use FICO's predictive analytics tools to identify customers who are likely to churn. This information can help the retailer develop targeted marketing campaigns to retain these customers.

An insurance company can use FICO's fraud prevention solutions to detect fraudulent claims. This can help the company reduce its losses and improve its bottom line.

IV. Financial Performance Analysis

a. Revenue & Free Cash Flow Growth

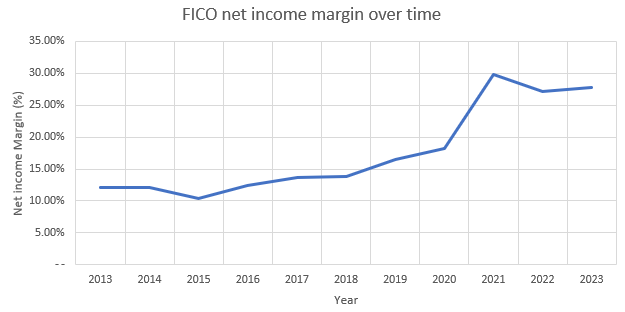

Despite only growing revenues at just under 8% annually, FICO has been able to demonstrate economies of scale, converting more dollars of revenue to the profit-line over the last decade.

The table above observes the historical data of the company in which we can see that this business has grown its bottom line across its EPS and FCF per share by over 20% annually.

b. Share price growth

Spot the difference?

FICO has beaten the benchmark by a factor of over 5x!

V. Competitive Advantages

Now, picture this: FICO as a mighty fortress, surrounded by a moat teeming with crocodiles – well, metaphorically speaking. This fortress represents FICO's competitive advantage, the impenetrable force shielding it from rivals. How? FICO's scoring models have become the industry's gold standard, backed by decades of wisdom and fortified by partnerships with financial giants. It's like having an ace up your sleeve that your opponents can't replicate.

Factors Contributing to FICO's Moat

Now, let's examine the bricks that make up FICO's impervious moat:

Expertise: FICO's team of experts, comprising data scientists, mathematicians, and financial professionals, crafts its scoring models with precision. This level of expertise can't be replicated overnight.

Historical Data: Decades of data collection and analysis have created a treasure trove of information that forms the bedrock of FICO's models. This extensive historical data gives FICO an edge that newcomers can't match.

Partnerships: Collaborations with financial giants have granted FICO exclusive access to real-time data. This access allows FICO to continually refine and enhance its models, staying ahead of the curve.

Conclusion

As the world continues to use credit to function, FICO is well equipped to attain secular growth and likely to retain its moat due to its reputation and services it offers to lenders and consumers all over the world.

If you missed the last article and enjoy reading about companies in the financial space that aren’t banks, we suggest you read this one on MSCI and it has increased 10 fold in the last decade.

Disclosure: We do have a position in FICO as of 28/09/2023, This is not a suggestion to buy or sell this security,

Past performance may not indicate future returns…

We also are experimenting in video formats.

Feel free to check this one out on ASML, a semi-conductor company.