Investing in Chocolate: A Delicious Way to Outperform the Market

Outperforming benchmarks with decadent confectionery

[Disclosure] - I do have positions of HSY & LISN, I am not advising to buy or sell this asset.

To put your money where your mouth is…

Today we look at 2 businesses that have outperformed the S&P 500.

HSY - The Hershey’s Co - an American food manufacturer with a predominant business in chocolate. Founded in 1894 [1]

LISN - Lindt (Chocoladefabriken Lindt & Sprüngli AG) - A Swiss chocolate maker founded in 1845. [2]

Market returns

HSY annualised returns (as of 24/02/2023)

3 years - 17.09%

5 years - 22.52%

10 years - 13.66%

15 years - 16.03%

20 years - 13.13%

LISN annualised returns (as of 24/02/2023)

3 years - 7.61%

5 years - 9.13%

10 years - 10.34%

15 years - 7.76%

20 years - 13.98%

S&P 500 annualised returns (as of 24/02/2023)

3 years - 6.39%

5 years - 8.30%

10 years - 10.19%

15 years - 7.53%

20 years - 8.19%

Increasing Chocolate Consumption

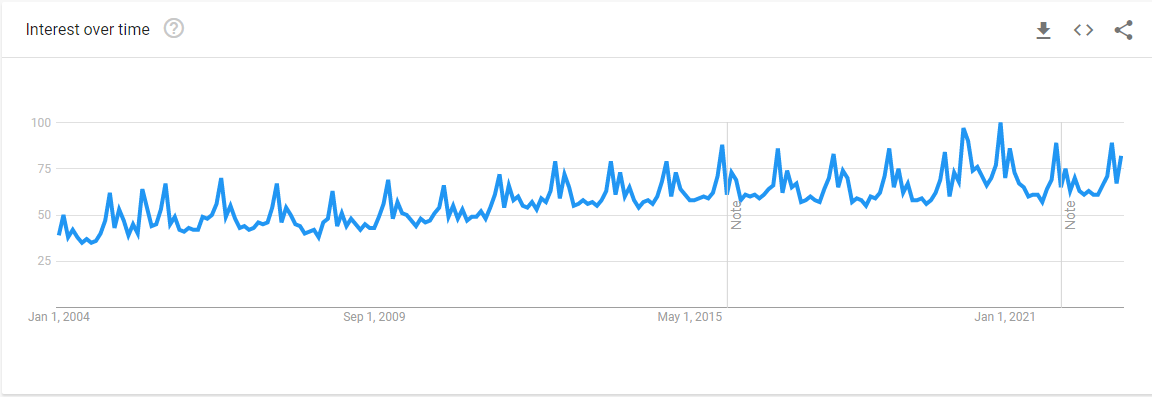

Google Trends - Worldwide Interest in Chocolate

Interest of chocolate has grown by 2% annually since 2004. [3]

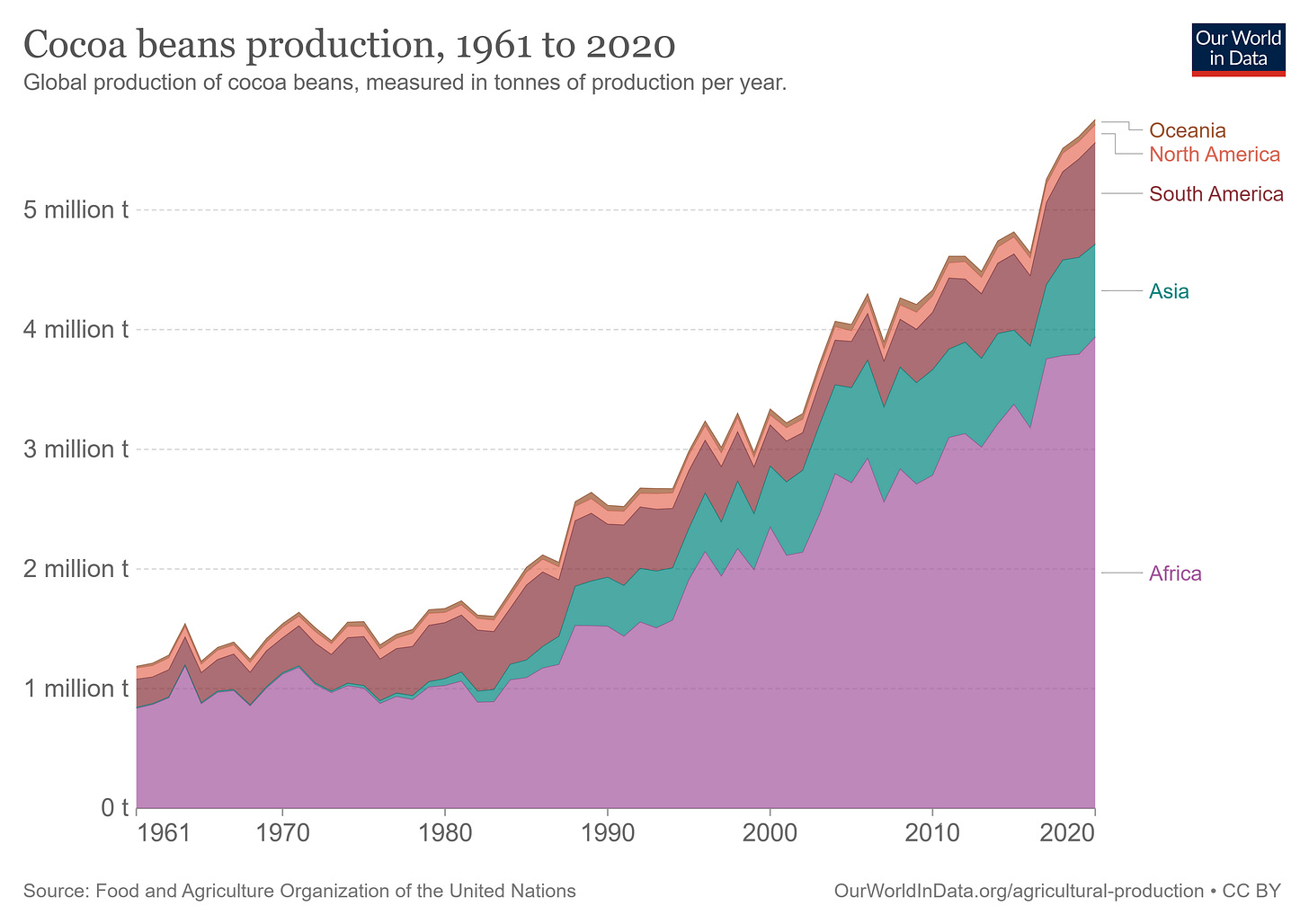

This observation is supported by cocoa production which has grown by over 2.5% annually over the last 20 years. [4]

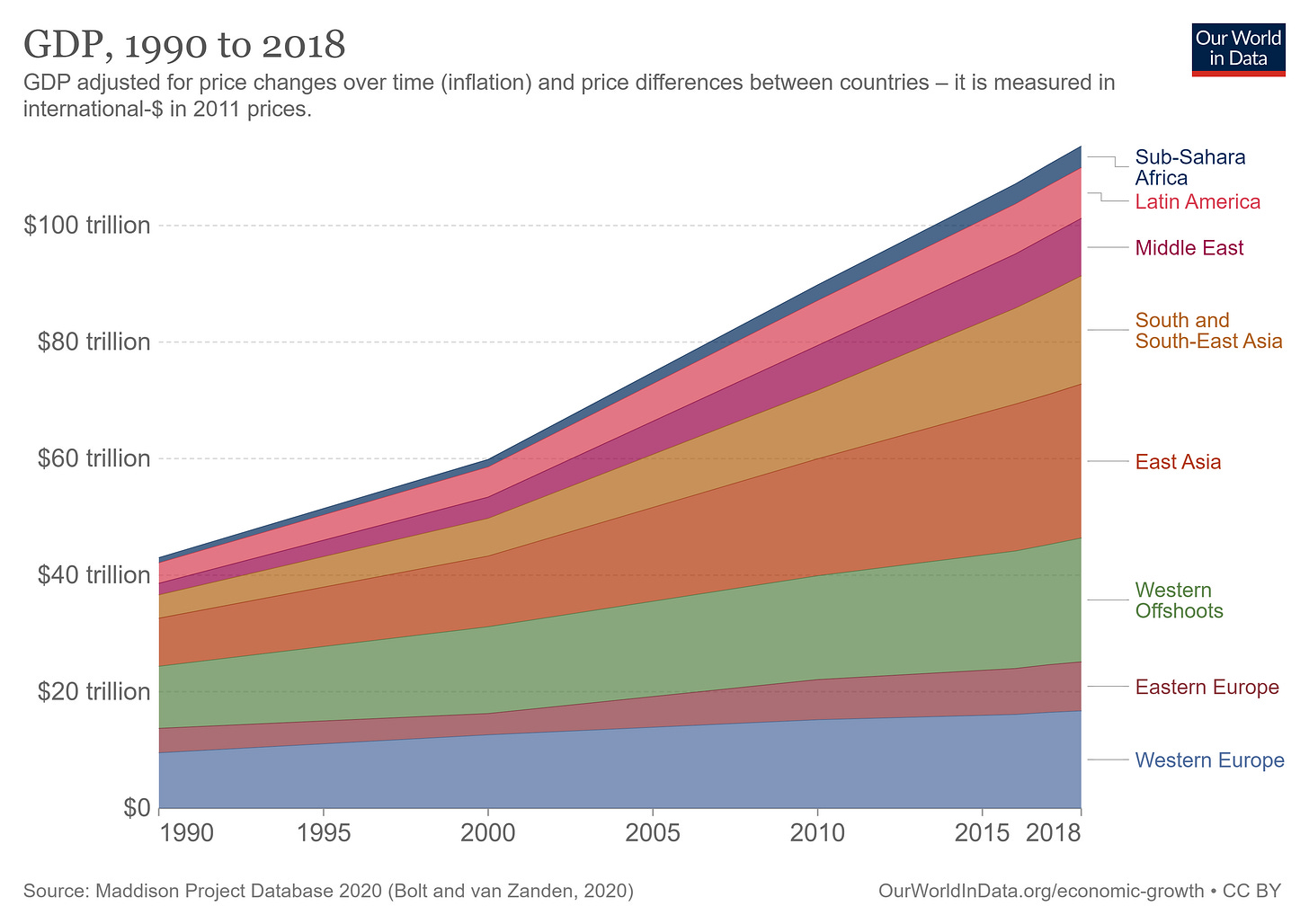

Global GDP growth has been 3-4% annually over the last 30 years. [5]

Chocolate is considered a luxury item. [6] As GDP of the world grows, the demand for consumer discretionary goods increases as more of the world become developed.

As “essential” spending becomes a lower % spend of total household, total consumer spending appears to be higher. [7].

These trends may be the tailwinds that these companies have received to allow them to grow over time.

Brand Value & the Lindy Effect

We could observe strong, recognisable brands may have the ability to outperform the market [8]. These brands appear to withhold economic downturns due to factors including strong intangible assets which may provide a competitive advantage.

This could be similarly related to what is known as the Lindy Effect, where the long something is exists, the more likely it would continue to exist [9]. For example to great Egyptian pyramids have been around for more 4500 years [10], whilst a one-hit wonder song in the 1950s or a viral video on Tik-Tok may only stay on the consumer radar for some years if not less.

Both of these companies are highly identifiable brands, being founded before the 1900s. Hershey’s chocolate market-share in the US is over 30% of chocolate and Lindt being 8.2% (third largest) with the second largest being Mars (a private company) holding over 26%. [11]

Business Fundamentals - HSY

HSY has been growing its revenue by 4.75% over 20 years but has also been able to extend its net margins from 9.79% to 15.78%. Similarly, EPS growth has exceeded 13% in the last 15 years as a result.

HSY Dividend growth - 10x in 20 years

Hershey’s has grown its dividend from $0.40 per share in 2003 to $4.00 per share in 2023, which amounts to a CAGR of 12.20%. [12]

Of course, past performance may not be a reliable indicator of future results.

Business Fundamentals - LISN

LISN has been growing its revenue by 4.7% over 20 years but has also been able to extend its net margins from 7.47% to 11%. Similarly, EPS growth has exceeded 13% in the last 15 years as a result.

LISN Dividend growth - 8x in 20 years

Lindt has grown its dividend from 143 CHF per share in 2002 to 1200 CHF per share in 2022, which amounts to a CAGR of 11.2%. [13]

Of course, past performance may not be a reliable indicator of future results.

Company outlook

Both businesses anticipate growth to continue and revenue for the year 2023 to be 6-8% with improving operating margins as well. [12], [13]

If they are able to execute, EPS growth would be antipated to grow at 11%-15% (with ongoing share repurchases), all despite the current lingering inflation & interest pressures consumers are facing.

If you enjoyed reading this one, I would encourage you to read this one next.

Until next time…

References

[1] https://www.thehersheycompany.com/en_us/home/about-us/the-company/history.html

[2] https://www.lindt.com.au/world-of-lindt/history

[3] https://trends.google.com/trends/explore?date=all&q=chocolate

[4] https://ourworldindata.org/grapher/cocoa-beans-production-by-region

[5] https://ourworldindata.org/grapher/gdp-world-regions-stacked-area?time=2000..latest&country=Sub-Sahara+Africa~Latin+America~Middle+East~South+and+South-East+Asia~East+Asia~Western+Offshoots~Eastern+Europe~Western+Europe

[6] https://www.mdpi.com/2071-1050/12/14/5586

[7] https://ourworldindata.org/grapher/food-expenditure-share-gdp?tab=table

[8] https://www.ncbi.nlm.nih.gov/pmc/articles/PMC6446061/

[9] https://gwern.net/doc/statistics/probability/1964-goldman.pdf

[10] https://www.nationalgeographic.com/history/article/giza-pyramids#:~:text=The%20Giza%20Pyramids%2C%20built%20to,constructed%20some%204%2C500%20years%20ago.

[11] https://www.statista.com/statistics/238794/market-share-of-the-leading-chocolate-companies-in-the-us/

[12] Hershey Financial Filings

[13] Lindt Financial Filings